This is another play I want to remember. It’s basically a more advanced view of the Spencer Special. In this case it was selling short GPN after a big gap up. We do not simply fade stocks because they are “over bought”. There were a lot of checks in favor of the short (and not at the top by any means), which could be replicated and thus be a play we make again.

The first thing we noticed was GPN on the top of almost every column on the Radar. This is a huge sign that the stock will have opportunity. Specifically, it was top Down Trend, Weak Today, and was highly In Play.

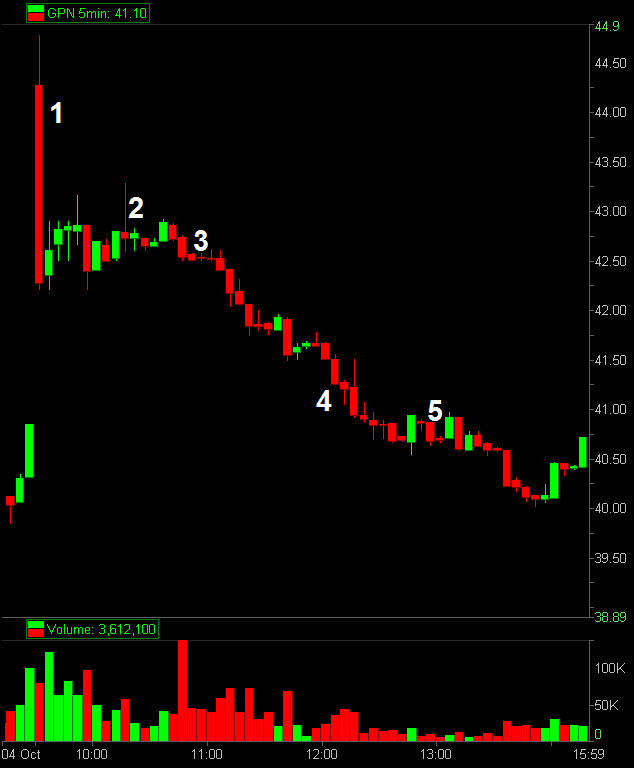

Here is how we viewed the stock.

1. Immediately has an aggressive sell-off from the 44.40 long term resistance area.

2. Tries to rally off of the lows but the bids aren’t holding it higher. This is a big sign that a lot of people want out and that the demand for the stock – even after such a heavy pull in -is minimal.

3. 42.50 holds the bid for 20 minutes (you can see it in the 1min chart) . This is where we looked to make a play (also the same time of the Radar snap shot you see above). So we have a stock that is unusually In Play, Top Weak Today / Downtrend, and is setting us up with a catalyst to enter the trade. Get short when 50c drops. Note: Depending on your stop, you may have been stopped out on this trade once. But it didn’t go above the tick range high of 62c before really failing about a minute later. Big picture, the psychology going on here is that GPN failed to hold its gap up and did a lot of volume attempting to do so. This traps a lot of longs to fuel the downside.

4. Target is reached here (gap fill).

5. Consolidates at the low, another play can be made here but not an initial position.

If not you can ask questions on this play below.

– tarhini_smb, trader

Disclosure: No position in GPN